Apple CEO Tim Cook has called for global corporate tax reform, adding that he is optimistic that the reform would be fair.

“It’s very complex to know how to tax a multinational,” Cook said during an awards ceremony in Dublin, held to mark 40 years of Apple in Ireland, according to Reuters.

“I think logically everybody knows it needs to be overhauled, I would certainly be the last person to say that the current system or the past system was the perfect system,” he added.

Big technology companies, such as Apple and Google, are currently facing increased scrutiny in various countries over their tax practices. These firms are accused of using various accounting tricks, for example, booking profit in low-tax countries, such as Ireland and Luxembourg, to dodge their liabilities.

The trend has also triggered the Organisation for Economic Cooperation and Development (OECD) to advocate the need to pursue a tax reform that will force multinational companies to pay tax in countries where they serve customers, regardless of where their income is eventually funnelled.

In October, the OECD came up with a proposal that gives individual governments more power to target multinational firms earn money in their country. The plan was announced after more than 130 countries agreed on the need for global tax reform. The OECD is expected to provide a more detailed plan later this month.

France is also vocal on corporate tax issue, and has proposed a digital services tax under which a select group of 30 firms, including Amazon, Google and Facebook, would face a three per cent levy on their sales in France.

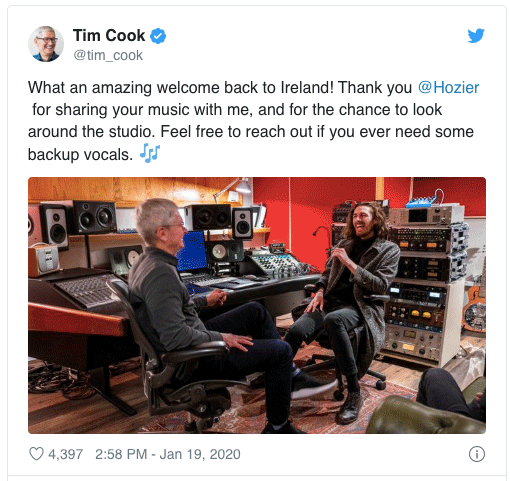

Ireland, which became Apple’s first European operation in 1980, is now the second home for the US company.

The Irish government and Apple are currently appealing a 2016 ruling from the European Commission, which found that the iPhone maker had received illegal state aid from Ireland, and therefore the company must repay €13bn in back taxes to the Irish government.

The declaration was made by Margrethe Vestager, the European Commissioner for Competition, following an investigation, which started in June 2014.

Vestager said that that Apple had attributed almost all profits made in the European Union to a head office based in Ireland, which only existed on paper and which could, therefore, not have generated such profits.

Apple said earlier that it was confident that the ruling would be overturned by the European courts.

During the Dublin event, Tim Cook also stressed on the need for more regulation in privacy, highlighting that “the companies will not self-police in this area.”

Featured News

DOJ and FTC Introduce Website for Reporting Anti-Competitive Healthcare Practices

Apr 18, 2024 by

CPI

US Congress Advances Legislation to Compel TikTok Sale

Apr 18, 2024 by

CPI

UK Financial Sector Advocates Enhanced Regulatory Accountability

Apr 18, 2024 by

CPI

Google and All 50 States Defend $700 Million Consumer Settlement

Apr 18, 2024 by

CPI

Colorado Enacts First Law to Protect Consumer Brainwave Data

Apr 18, 2024 by

CPI

Antitrust Mix by CPI

Antitrust Chronicle® – China Edition – Year of the Dragon

Apr 16, 2024 by

CPI

Review Logic and Rules for Concentrations of Undertakings that Do Not Meet the Standard of Notification

Apr 16, 2024 by

CPI

China’s Review of Semiconductor Transactions

Apr 16, 2024 by

CPI

Key Challenges and Tips for Merger Control Filing in China for Listed Companies

Apr 16, 2024 by

CPI

Key Point Review: China SPC Antitrust Judgments in 2023

Apr 16, 2024 by

CPI