Mar 20, 2014

CPI Europe Column edited by Anna Tzanaki (Competition Policy International) presents:

Minority Shareholdings: Using a Sledgehammer to Crack a Nut by Christoph Barth (Linklaters LLP) and Juan Restrepo-Rodríguez (Linklaters LLP)

Intro by Anna Tzanaki (Competition Policy International)

In our March edition of the Europe Column, Christoph Barth and Juan Restrepo-Rodríguez (Linklaters) revisit the issue of non-controlling minority shareholdings from a comparative perspective. The authors shed light on the gaps of the current EU competition law regime and they point to a potential need for reform of EU merger control to extend the Commission’s jurisdiction to such cases. Notably, German merger control allows scrutiny of shareholding acquisitions well below the applicable EU thresholds. Drawing on German decisional practice, however, the authors advocate that an ex post system of control with a well-defined safe harbour is preferable in the case minority shareholdings falling short of control. As a matter of policy, they suggest that this legal solution is better aimed to ensure legal certainty and avoid an increased number of unnecessary notifications as evidenced under an ex ante control system. We shall wait and see if the Commission is of the same opinion. Enjoy reading!

The European Commission (the “Commission”) is currently considering a revision to the treatment of non-controlling minority shareholdings.1 So far its jurisdiction has been limited to the control of shareholdings that cause the ability of exercising decisive influence on an undertaking on the basis of rights, contracts or any other means (Article 3 European Merger Control Regulation, “EUMR”). This scope has been confirmed by the General Court in the famous Aer Lingus case, where it decided that the acquisition of a non-controlling minority shareholding did not form a concentration within the framework of the EUMR. The court stated clearly that “the concept of concentration cannot be extended to cases in which control has not been obtained.”2

Following the Aer Lingus case, the Commission today takes the view that it is not equipped with the appropriate tools to prevent anticompetitive effects deriving from so called “structural links” that on the one hand do not confer the ability to exercise decisive influence but on the other hand allow the shareholder to exert some influence over the target.3 The Commission acknowledges that only a “limited number of problematic cases” exist and that “currently only limited empirical literature” on the effects of such cases is available.4 This raises a number of questions, including: Is there really a material gap in the EUMR? If there is, should it be closed by an expansion of the Commission’s power to investigate all structural links?

The Case for a Gap

Back in 2001 the Commission answered the first question as follows:

“[B]ased on current experience, it appears that only a limited number of such transactions would be liable to raise competition concerns that could not be satisfactorily addressed under Articles [101] and [102 TFEU]. Under this assumption it would appear disproportionate to subject all acquisitions of minority shareholdings to the ex ante control of the Merger Regulation.”5

This finding is backed up by economic theory strongly suggesting that minority shareholdings are significantly less likely to give rise to competition concerns compared to full-fledged mergers. However, there is no doubt that under certain circumstances horizontal unilateral effects, coordinated effects or vertical foreclosure effects are possible.

Horizontal unilateral effects

A possible theory of harm is that, post transaction, the acquirer has an incentive to increase prices, as some of the lost sales will be recouped through the shareholding in the target. However, an increase in price is only plausible where the following cumulative conditions are met:

- the purchaser must be able to calibrate the impact of a price increase for both its own sales and those of the target; and

- the purchaser must be able to predict that sales are diverted to the target and that competitors do not run a promotion and thereby capture all of the diverted sales.

However, it is more likely that such information will not be available to the relevant companies and that, where information is available, it is unreliable and that market factors will counteract any attempt to increase prices.

Coordinated effects

It is generally accepted that under EU merger control structural links are a relevant factor in determining whether coordinated effects are likely, but it is less likely that such links are sufficient to meet the Airtours criteria.6 However, the exchange of strategic information between the purchaser and the target can be problematic and interlocking directorates may facilitate the access to or the exchange of such information. In any event, such an information exchange could alternatively be subject to an investigation under Article 101 TFEU or the national equivalent, for example the German Section 1 of the Act against Restraints of Competition (“ARC”).

Vertical foreclosure effects

Another possible theory of harm, which has frequently been used in cases involving minority shareholdings in the energy sector in Germany and which was for example the sole basis for the prohibition decision in E.ON / Stadtwerke Eschwege,7 are vertical foreclosure effects, e.g. impeding competitors’ access to customers by the purchaser.

In short, while there may well be a case for a gap, the second relevant question is how the rules need to be designed to distinguish structural links that should be subject to Commission jurisdiction from those that shouldn’t.

Lessons to learn from Germany

Back in 2001, the Commission found that:

“it appears doubtful whether an appropriate definition could be established capable of identifying those instances where minority shareholdings and interlocking directorships would warrant such treatment.”8

Indeed, a brief examination of 40 years of German merger control of minority shareholdings sheds some light on how rules should not be designed or interpreted.

The German Approach

German merger control not only applies to acquisitions of control. Since the early days of German merger control, the Federal Cartel Office (“FCO”) has also had jurisdiction to look into the acquisition of shares in another undertaking if the shares reach at least 25 percent of the capital or the voting rights of the other undertaking. Further, for nearly 25 years, German merger control has applied to “any other combination of undertakings enabling one or several undertakings to directly or indirectly exercise a competitively significant influence on another undertaking” (Section 37(1) no. 4 ARC).9 When introducing the concept of “competitively significant influence”, the legislator’s main objective was to capture corporate links below the 25 percent threshold, which give reason to expect that competition between the undertakings involved will be restricted to such an extent that they might no longer act independently on the market.10

The assessment of whether a transaction falls within the scope of the competitively significant influence test requires a thorough assessment, taking into account a broader set of facts, and it partially overlaps with the substantive assessment of the case. The decisive aspect in the end is whether the minority stake confers an influence on the target’s decision-making processes and its market behavior and whether it can reasonably be expected that the target will take into account the business interests of the minority shareholder (or vice versa). Taking into account the legal uncertainty caused by this new test, transactions were initially subject to an ex post investigation only. This eventually changed through the sixth amendment of the ARC, which came into effect in 1999. Since then, every merger that falls within the scope of Section 37 ARC is subject to both, an ex ante review and the standstill obligation.

While the acquisition of a 25 percent shareholding is an unambiguous threshold, the concept of competitively significant influence (which is subsidiary to any other type of concentration) is all but clear-cut and always involves a case-specific analysis. Therefore, it is not surprising to see that the FCO declines jurisdiction in around 11 percent of all cases in which notifications have been submitted for acquisitions of competitively significant influence. Essentially, three cumulative conditions can be identified from the case law, which typically need to be met to trigger a filing:

- the shareholders’ position is de jure or de facto comparable to the position of an at least 25 percent shareholder;11

- this position has been obtained on a lasting basis; and

- the purchaser and the target are actual or potential competitors or a vertical relationship exists among the parties.12

Relevant factors in this analysis are, inter alia, the right to appoint members of the board, information rights or veto rights (falling below the control threshold), a stable 25 percent position at the shareholders’ meeting, an in-depth knowledge of the relevant industry compared to other shareholders, on-going business relationships as a supplier or customer, or call options which confer a majority shareholding upon being exercised.

How to separate the good from the bad

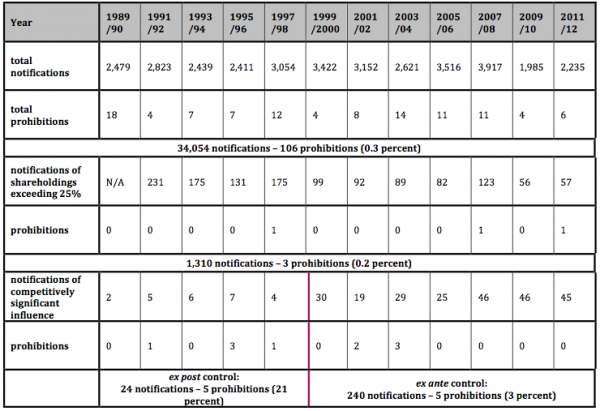

An evaluation of almost 25 years of FCO decisional practice reveals that the ex post system, as it was in force until 1998, had benefits which the current system of ex ante control does not have. In the first ten years, more than 20 percent of the notified cases were ultimately prohibited. The change in 1999 inflated the number of notifications by a factor of 10, but the absolute number of prohibitions remained unchanged. By comparison, the low number of prohibitions in case of shareholdings exceeding the 25 percent threshold shows that such a threshold, while being fairly straightforward, is arbitrary. The overall level of prohibition decisions in Germany is already relatively low (0.3 percent compared to 0.4 percent under the EUMR),13 however it is another 30% down to 0.2 percent in case of acquisitions of a non-controlling shareholding exceeding the 25 percent threshold.

Table: Notifications and prohibition decisions from 1989 to 2012

Source: FCO’s activity reports. Information for 2013 is not yet available.

In the last ten years, in around 10 percent of cases, in which parties filed an acquisition of competitively significant influence, the FCO ultimately decided that the transaction did not constitute a notifiable concentration, 75 percent of the cases were cleared in Phase I, 5 percent in Phase II. The remainder were prohibited or parties pulled the filing or modified the concentration to render it non-notifiable. So far, there is only one case in which the FCO has conditionally cleared a transaction (Asklepios’ acquisition of 10.1 percent of the shares in Rhön).14 In that case, the purchaser committed to divest one hospital and a medical service center to an independent hospital operator. However, only a few months after clearance, the purchaser abandoned its commitment, and consequently the FCO declared the transaction as prohibited.15

The need for a safe harbor

If the Commission would decide to choose a system of ex ante control, which would be consistent with the “one-stop shop” principle, but would be likely to inflate the number of filings, German experience shows that a strong need for a safe harbor exists.

While a rule of thumb suggests that competitively significant influence is more likely to be found if the relevant transaction relates to the acquisition of a shareholding just below the level of 25 percent, on a number of occasions the FCO looked into shareholdings significantly below this level.

In 2004 publishing house DuMont Schauberg intended to acquire a 18% shareholding in the newspaper printing company Bonner Zeitungsdruckerei. Following concerns raised by the FCO, DuMont Schauberg reduced the level of shares it intended to acquire to 9 percent. However, still the FCO found competitively significant influence, also taking into account different economic links among the parties, and ultimately prohibited the transaction.16

Three years earlier, the FCO went even further: A consortium of Edelhoff (part of the RWE group) and Lobbe intended to acquire 49 percent of the shares in the waste management company AMK. The transaction consisted of two steps: (i) the acquisition of the shares by a special intermediary holding company in which Lobbe held 99 percent and Edelhoff 1 percent. Subsequently, the parties intended to set up a separate property company held by Edelhoff (33 percent) and by Lobbe (16 percent) and by the seller (51 percent). However, the FCO held that Edelhoff’s envisaged participation in the first step of the transaction, despite being as low as 1 percent, together with existing contractual relationships, would have constituted a competitively significant influence.17 In the end, Edelhoff did not acquire a shareholding but only entered into a number of agreements with AMK.

Again more questionable, in another case, the FCO did not even require the acquisition of a share to find competitively significant influence. In 2003, building materials company Xella developed a restructuring plan for a medium-sized manufacturer of concrete. In accordance with the restructuring plan, Xella intended to provide a loan to the target in return for an irrevocable and temporary call option of a 50% stake in the target. In addition, it was entitled to appoint one member of the board of the target company. The FCO held that the option and the right of appointment were sufficiently similar to an actual purchase of shares because the corporate bodies of the operating company would have been under the pressure that the option holder may exercise the option at any time if its interests were not protected. Therefore, the FCO took the view that the agreement would constitute a legal relationship amounting to competitively significant influence.18

Another relevant factor, potentially leading to competitively significant influence, is the right of nomination or appointment of members of the supervisory board, even if the shareholding is not increased. In 2008, A-Tec, then holding 13.8% of the shares in its competitor Norddeutsche Affinerie, a major European copper producer, decided to appoint three (out of twelve) members of the supervisory board of the company. The FCO found that, due to low presence at the target’s AGMs, the shareholding was sufficient to give A-Tec the rights of a 25% shareholder. Further, it found that the three members of the supervisory board and the fact that A-Tec was the sole shareholder with an in-depth knowledge of the relevant industry would have lead to the acquisition of competitively significant influence. The FCO (upheld upon appeal)19 ultimately prohibited the transaction.

Finally, it is also possible that a purchaser, together with another shareholder, acquires joint competitively significant influence, which also triggers a filing. In 2009, Gazprom informed the FCO of its intention to increase its shareholding in its customer VNG, a gas distribution company, from 5.26 percent to 10.52 percent. The FCO took the view that the transaction was notifiable on the basis of joint competitively significant influence20 conferred upon Gazprom and another minority shareholder, Wintershall, owning 15.79 percent, with whom Gazprom cooperated extensively for over twenty years in the gas sector. The joint influence over VNG was ultimately based on the fact that the joint shareholding exceeded the threshold of 25 percent and that, according to the FCO, Gazprom and Wintershall would be informed of all relevant strategic and operational decisions and objectives of VNG.21

Subsequently Gazprom tried to avoid a notification by waiving, for a period of two years, the right to vote 1.88 percent of the shares and the right to nominate one member to VNG’s supervisory board. However, the FCO required Gazprom to notify the transaction prior to the expiry of the waiver. In 2011, Gazprom notified the acquisition of a permanent increase in voting rights by 1.88 percent to 10.52 percent as well as the right to nominate one member of the supervisory board of VNG. Following a four months Phase II-investigation, the FCO ultimately cleared the transaction, after it found that a foreclosure theory would not be plausible as VNG’s gas demand was only a very small portion of overall German gas demand.

Finally it is worth noting, that in more than 10 percent of the cases in which the notifying parties consider a transaction to lead to competitively significant influence, the FCO ultimately declines jurisdiction. Therefore, although a significant number of transactions involving competitively significant influence have been notified in the past 40 years, the interpretation of which has been subject to an intense academic debate and protracted litigation, there is still a strong need for a safe harbor in Germany, to further increase legal certainty and to avoid a creeping extension of jurisdiction.

Cracking the nut with a nutcracker

Against the backdrop of German decisional practice, there seems to be a good case for an ex post system to scrutinize minority shareholdings at EU level, avoiding the notification of possibly hundreds of transactions that are inherently unlikely to raise competition concerns. This seems to be appropriate in light of the fact that today minority shareholdings are far from being immune22 and that the “enforcement gap” is effectively limited to rare situations where a minority shareholding does not confer decisive influence, is not associated with an agreement or concerted practice and does not involve a pre-existing dominant company.

It could be wider, if the Commission were to state that it does not intend to use the dormant Philip Morris doctrine any longer, which once was welcomed by the then Commissioner Sutherland as an “unambiguous confirmation that Article [101] and [102] apply to transactions relating to change in corporate ownership.” It is understood that internally the Commission’s Legal Service does not want to open the floodgates for investigations under Articles 101 and 102 TFEU into minority shareholdings (and indeed there have not been any such investigations in at least the last ten years). Finally, given that that the Commission is a role model for many other competition authorities a serious risk exists that, if the Commission were to decide to expand jurisdiction, other authorities would follow the example and would adopt similar regimes (not necessarily interpreting the relevant provisions in the same way and also not necessarily applying plausible theories of harm). Therefore, it is essential that the Commission sets a good example and uses a nutcracker to crack the nut.

(Click here for a PDF version of the article.)

1 To the extent that this article refers to “minority shareholdings” or “structural links”, such references always relate to non-controlling minority shareholdings. It is worth recalling, that the Commission previously found de facto sole control at a level of shareholding being as low as 19%. Commission, decision of 25 September 1992, Case M.258 – CCIE / GTE.

2 General Court, judgement of 6 July 2010, Case T-411/07, para 65.

3 Commission, Staff Working Document dated 25 June 2013, “Towards More Effective EU Merger Control”, p. 3 (“Staff Working Document”).

4 Staff Working Document, p. 3; Annex I, para 23.

5 Commission, Green Paper on the Review of Council Regulation (EEC) No 4064/89, COM(2001) 745 final, dated 11 December 2001, para 109.

6 General Court, judgement of 6 June 2002, Case T-342/99, para 62.

7 FCO, decision of 12 September 2003, Case B8-21/03; upheld upon appeal by the Higher Regional Court of Dusseldorf, judgement of 6 June 2007, Case VI-2 Kart 7/04 (V) and the Federal Court of Justice, judgement of 11 November 2008, Case KVR 60/07.

8 Commission, Green Paper on the Review of Council Regulation (EEC) No 4064/89, COM(2001) 745 final, dated 11 December 2001, para 109.

9 Previously Section 23(2) no. 6 ARC 1990.

10 Cf. draft law of 30 May 1989, Parliament’s paper (Bundestagsdurcksache) no 11/4610, p. 20.

11 NB: It is questionable whether there is good reason for the 25% threshold as under German corporate law, a 25% shareholder (strictly speaking 25% plus one vote in the case of German stock corporations [Aktiengesellschaft]) can typically only block certain corporate matters, such as amendments of the articles of association, capital increase and decrease, termination of the corporation and squeeze-out or recall of supervisory board members. Under German corporate law, the executive board of a stock corporation manages the company independently and is not subject to direct instructions by the shareholders or the supervisory board. However, the picture is slightly different for limited liability companies (Gesellschaft mit beschränkter Haftung), where the shareholders are entitled to instruct the managing directors. However, even in this regard, a minority shareholder normally cannot determine the outcome of shareholders’ meetings. Also information rights are wider in the case of limited liability companies. However, it can still safely be said that in the case of the most common corporate legal forms in Germany, a 25% shareholding does not confer rights that can be assumed to confer critical influence on the company. Also see Schmidt, Germany: Merger control analysis of minority shareholdings – A model for the EU?, Concurrences 2013, p. 211 et seq.

12 See Bardong, Merger control and minority shareholdings: Time for a change?, Concurrences 2013, p. 32. However, recently the FCO investigated the SAP’s then minority stake in Crossgate, pursuing a theory of harm based on conglomerate and network effects. Cf. FCO activity report 2011/2012, p. 93.

13 See Commission, merger control statistics at http://ec.europa.eu/competition/mergers/statistics.pdf.

14 FCO decision of 12 March 2013, Case B3-132/12.

15 FCO press release of 30 July 2013.

16 FCO, decision of 8 September 2004, Case no. B6-27/04. Upon appeal, the Higher Regional Court of Dusseldorf (Case VI-Kart 26/04 (V)), following further modifications to the proposed concentration, ultimately annulled the FCO’s decision.

17 FCO activity report 2001/2002, p. 16 et seq.

18 FCO activity report 2007/2008, p. 80.

19 Higher Regional Court of Düsseldorf, decision of 12 November 2008, Case VI-Kart 5/08 (V).

20 Comparable cases are the 1991 case of Allianz increasing its stake in Dresdner Bank from 19.1 to 22.3%, where the FCO found joint competitively significant influence together with other pre-existing shareholders from the insurance sector. Ultimately, the FCO cleared the transaction, after Allianz had ended existing relationships with other life insurers (cf. FCO activity report 1991/92, p. 24). The key element for the finding of joint competitively significant influence is a commonality of interests among the relevant shareholders (also see the media sector cases CLT / UFA / RTL2, reported in Monopoly Commission, 10th Report 1992/93, para 652 and Roth+Horsch Pressevertrieb / Pressevertrieb Pfalz, FCO decision of 30 March 2010, Case B6-98/09). In the latter case the FCO could not find joint competitively significant influence on the grounds of lack of a commonality of interests.

21 FCO decision of 31 January 2012, Case B8-116/11.

22 Burnside, Minority Shareholdings: An overview of EU and national case law, e-Competitions no. 56676.

Featured News

DOJ and FTC Introduce Website for Reporting Anti-Competitive Healthcare Practices

Apr 18, 2024 by

CPI

US Congress Advances Legislation to Compel TikTok Sale

Apr 18, 2024 by

CPI

UK Financial Sector Advocates Enhanced Regulatory Accountability

Apr 18, 2024 by

CPI

Google and All 50 States Defend $700 Million Consumer Settlement

Apr 18, 2024 by

CPI

Colorado Enacts First Law to Protect Consumer Brainwave Data

Apr 18, 2024 by

CPI

Antitrust Mix by CPI

Antitrust Chronicle® – Economics of Criminal Antitrust

Apr 19, 2024 by

CPI

Navigating Economic Expert Work in Criminal Antitrust Litigation

Apr 19, 2024 by

CPI

The Increased Importance of Economics in Cartel Cases

Apr 19, 2024 by

CPI

A Law and Economics Analysis of the Antitrust Treatment of Physician Collective Price Agreements

Apr 19, 2024 by

CPI

Information Exchange In Criminal Antitrust Cases: How Economic Testimony Can Tip The Scales

Apr 19, 2024 by

CPI